Why financial firms need granular governance for Gen AI

Learn how granular governance helps financial institutions scale AI systems securely, from maintaining compliance and protecting data to controlling costs and preventing misuse.

Banks and financial firms are investing in Generative AI, which is making waves across the industry. From chatbots helping customers with their questions to AI systems combing through compliance documents, these tools are changing how financial work is done. But there's a catch: As more teams start using AI, they're facing some thorny challenges regarding security and compliance.

When you're dealing with people's money and personal information, you need rock-solid control over how AI systems operate. That's where granular governance comes in. It's about having detailed oversight of your AI operations - having precise controls for every part of your AI system, from how it handles data to who can access what.

Let me walk you through why this matters and how financial institutions are tackling these challenges. Rather than giving you a birds-eye view, we’ll share specific examples of how teams are implementing these controls in practice.

What is granular governance in Gen AI?

When we talk about granular governance in Gen AI, we're talking about having precise control over your AI systems - from start to finish. In AI, these controls let you fine-tune who can use the system, what data goes in, and what comes out.

First, there's access control. Just like you wouldn't give everyone in your organization admin access to your databases, you need to be smart about who can use and modify your AI systems. You might want your customer service team to use certain AI features while keeping model training capabilities limited to your technical teams.

Next is monitoring and tracking. Every time someone uses the system, every piece of data that passes through it is logged. Think of it as having security cameras in a bank. If something goes wrong, you can go back and see exactly what happened and why.

Finally, you need policy enforcement. These are company-wide policies that spell out how AI should be used. For example, you might set rules about what data can be processed or what types of outputs are acceptable.

Why financial firms need granular governance

If you work in or for finance, you know the drill - SOC2, GDPR, and a whole alphabet soup of compliance requirements. When you're using AI, you need to prove that every piece of data stays where it should and follows the rules. For global teams, this means making sure customer data from Germany stays in the EU, while data from Singapore follows APAC regulations.

Financial AI systems handle everything from account numbers to trading strategies. You need ways to spot and protect sensitive information automatically - like catching when someone accidentally feeds private customer details into a model and stopping it before it becomes an issue.

Running AI at scale brings its own headaches. Say you've got different AI models helping with fraud detection across multiple regions. You need to keep track of which version runs where, update them without breaking anything, and make sure they stay accurate.

Money matters too. AI costs can spiral quickly if you're not watching closely. Smart governance lets you set spending limits and track usage patterns. For example, you might notice certain teams are running expensive queries that could be cost-optimized, or find ways to batch processes more efficiently.

AI is powerful, but with that power comes responsibility. You need clear guardrails about what the AI can and can't do. This might mean setting up checks to prevent unauthorized model tweaks or making sure AI outputs align with your ethical standards.

How granular governance transforms Gen AI for financial institutions

System Reliability

Good governance means your AI systems stay running. With 99.9999% uptime and built-in failover systems, teams don't lose time to outages. When problems occur, backup systems take over automatically, keeping operations smooth.

Clear Audit Records

Every AI interaction gets logged and stored. This means when someone asks about a specific decision or process, you have the data ready. Teams can access detailed audit trails showing inputs, outputs, and the steps between - exactly what auditors and regulators want to see.

Faster Compliance

Governance tools automate much of the compliance reporting process. Teams can quickly show how their AI systems handle data, enforce rules, and meet regulatory requirements. This cuts down review times from weeks to days or hours.

More Time for Development

When governance handles the guardrails automatically, development teams spend less time managing compliance and more time building new features. They can work on improvements knowing the system will flag any compliance issues before they become problems.

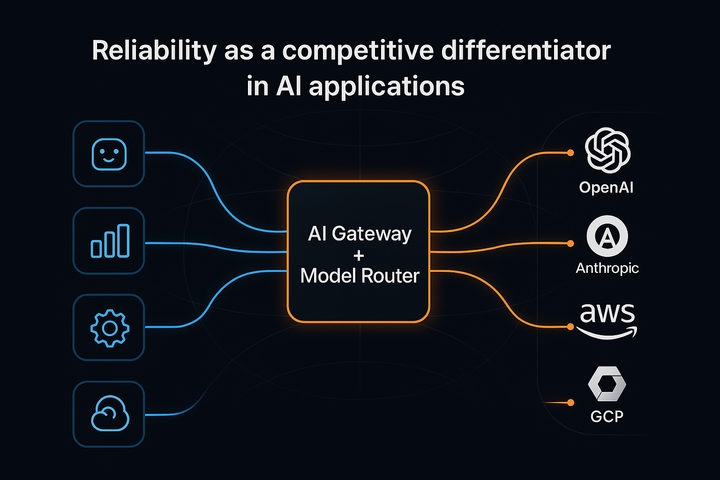

Portkey enables granular governance

Portkey provides financial institutions with the tools needed to implement granular governance seamlessly.

Key features include:

- Organization-Wide Guardrails: Define and enforce usage policies with guardrails across all AI systems.

- Detailed Request Tracking: Maintain audit trails to monitor AI performance and compliance.

- Secure Deployment Options: Support for air-gapped environments and on-premise deployments.

With proven results among Fortune 500 financial institutions, Portkey is the trusted platform for scaling Gen AI with confidence. By enabling granular governance, Portkey empowers firms to innovate faster while maintaining ironclad compliance and reliability.

Managing AI in finance comes down to balancing power with control. Strong governance lets you move quickly while staying secure. You can give teams the AI tools they need while keeping data safe and following industry rules.

Getting governance right means your AI systems stay within regulatory bounds, keep sensitive data protected, run reliably and predictably, stay on budget, and maintain clear audit trails. When financial teams set up proper controls from the start, they spend less time worrying about compliance and more time building useful AI features.